The Fourth Turning: A Solution

Every few generations, society reaches an inflection point or upon reflecting our current situation, a moment when existing institutions lose credibility, collective trust fades, and a new order begins to emerge from the remnants of the past. Our current era reflects such a turning point. The legacy financial system, characterized by opaque hierarchies and unrestricted money creation, is approaching its natural limits. In this context, crypto is not merely a speculative trend—it represents the technological foundation for the next phase of societal trust and economic organization.

The Failure of the Old System

The post-Bretton Woods era has been marked by fiat currency and centralized control, stretching the idea of stability to its breaking point. Since the United States abandoned the gold standard in 1971, the dollar has lost over 85% of its purchasing power. At the same time, the financial system has become increasingly fragile, relying on central banks, intermediaries, and political discretion. While the “money printer” may maintain the appearance of prosperity, it cannot generate real productivity; instead, it distorts prices, erodes savings, and misallocates capital.

Similarly, the Web2 architecture of the digital economy shares many of these shortcomings. Though efficient, it is fundamentally extractive, privatizing data and monetizing users. The value generated by millions is concentrated among a few centralized platforms. Both the monetary and digital systems of the twentieth century are reaching their natural entropy. To progress, efficiency, transparency, and ownership must be reimagined from the ground up.

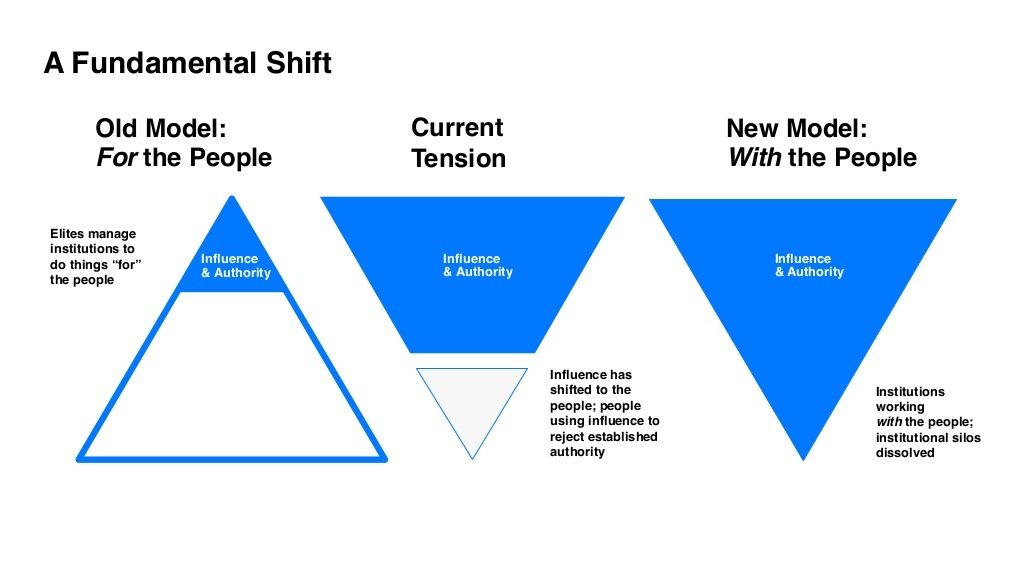

The Transition to Open Systems

Crypto, often referred to as Web3, is the blueprint for this rebuild. It marks the evolution from closed, institution-based trust to open, code-based trust. Just as accounting revolutionized commerce and the internet transformed communication, blockchains are redefining how value is organized and transferred.

Through open-source protocols, societies can now coordinate capital, code, and community without the need for permission or rent-seeking intermediaries. Transactions and value transfer occur at the speed of information, validated by mathematical principles rather than human bias. Crypto is not simply replacing money, it is revolutionizing the organization of money, ownership, and governance.

Bitcoin: The Digital Gold Standard

Bitcoin is the embodiment of the first principle underlying this transition: scarcity. With a fixed supply of 21 million coins, it stands in stark contrast to the limitless nature of fiat currency. Bitcoin is a neutral, apolitical form of money and the first since gold, designed for the digital age. Its significance extends beyond monetary policy; it represents the separation of money and state, akin to how the enlightenment separated church and state. As digital gold and the backbone of a global settlement network, Bitcoin provides a base layer of trust that is immune to corruption and inflation.

Historical Parallels

Throughout history, every major turning has followed a similar pattern:

The printing press decentralized knowledge.

The internet decentralized communication.

Crypto is now decentralizing value.

Each of these shifts faced skepticism, dismantled established power structures, and gave rise to new methods of coordination that advanced society. Open protocols have consistently triumphed over closed systems—not immediately, but inevitably.

Opportunity Cost

Every generation is presented with a choice: to defend the old order or to invest in the new. The opportunity cost of ignoring crypto may prove far greater than the perceived risk of engaging with it. Traditional markets now operate on thin margins, inflated valuations, and declining real returns with systems designed to preserve wealth, not create it. In contrast, crypto is an open frontier where innovation compounds and value accrue to those willing to participate early.

For the first time, individuals can hold assets that are not liabilities on another balance sheet, transact globally without permission, and gain exposure to protocols that reward usage rather than gatekeeping. It is a structural shift from custodial finance to self-sovereign capital or from being a client of the system to being a stakeholder in it.

While legacy finance focuses on yield, crypto focuses on freedom. One optimizes returns within the system; the other redefines what the system can be. In this Fourth Turning, the asymmetry lies not just in price potential, but in paradigm potential. The decision is no longer between risk and safety; it is between obsolescence and participation.

Crypto is not an alternative asset class; it is the next operating system for capital. And in an era defined by debasement, transparency, and technological acceleration, owning a piece of the new system may be the most rational trade of all.

Summary

Traditional banking and wealth management revolve around three pillars: custody, intermediation, and opacity.

Crypto dismantles all three:

Custody becomes self-sovereign.

Intermediation becomes automated.

Opacity becomes transparent.

The institutions of the 20th century ran on trust in people and paper. The institutions of the 21st will run on trust in code and consensus.

I include these as real world examples and it doesn’t even scratch the surface on what has been created and will be created over time.

The Opportunity Cost of Timing

In every era of technological upheaval, the real risk isn’t in being early — it’s in being late. Entering the crypto industry today is analogous to understanding the internet in the early 1990s or cloud computing in the early 2000s: the infrastructure is visible, the value creation inevitable, but mass adoption has yet to be priced in.

As of this writing, the entire global cryptocurrency market, encompassing thousands of assets, protocols, and emerging financial systems stands at approximately $3.9 trillion.

By comparison, NVIDIA, a single publicly traded company, commands a market capitalization of roughly $4.5 trillion.

That comparison alone should give pause. One company, no matter how innovative, now carries a valuation greater than the combined worth of an entire parallel financial ecosystem — one rebuilding global payments, lending, identity, trading, and settlement from first principles.

For perspective:

The internet sector in the mid-1990s was worth less than a handful of blue-chip industrial firms.

Twenty years later, those early networks became the backbone of the global economy birthing Apple, Amazon, Google, and Meta.

Crypto stands at that same threshold today: a misunderstood infrastructure that will soon underpin not just digital assets, but commerce, capital markets, and even monetary policy.

The opportunity cost of waiting five or ten years is not simply missing price appreciation it’s forfeiting the asymmetry of understanding.

Early adopters today gain literacy in the protocols, systems, and instruments that will define tomorrow’s financial architecture. Those who wait will enter later at higher valuations, in a more saturated field, when the extraordinary has already become the ordinary.

Learning this space today, even without immediate capital exposure, is an investment in optionality. Crypto represents a low-cost call option on the modernization of global finance. The premium is time and attention. The potential return is generational.

Choosing to ignore it, then, is not a decision of caution it is a decision of opportunity cost.