Market Evolution Through Ranger’s Execution Layer

Much of the discussion around crypto markets continues to focus on liquidity. In practice, liquidity is not scarce — it is fragmented.

Across ecosystems such as Solana and emerging venues like Hyperliquid, tens of billions of dollars in daily derivatives volume already exist. Yet most trading applications still force orders into single venues, leaving traders exposed to unnecessary slippage, suboptimal pricing, and execution risk.

This is a market structure problem, not a liquidity one.

Aggregation at the Application Layer

Fragmented markets are not unique to DeFi. Traditional equities, futures, and FX markets evolved under similar conditions. The long-term solution was not venue consolidation, but aggregation paired with intelligent routing at the application layer.

Ranger is designed explicitly around this principle.

Ranger integrates liquidity from multiple sources across the Solana ecosystem and beyond, allowing traders to access the best available pricing with minimal market impact. Rather than competing with individual protocols, Ranger operates above them, abstracting venue complexity and focusing on execution quality.

Smart Order Routing as Core Infrastructure

At the center of Ranger’s architecture is its Smart Order Router (SOR) — a real-time execution engine built to optimize price, slippage, fees, and reliability.

When a user initiates a trade, the SOR:

Analyzes order parameters and current market conditions

Assesses liquidity across integrated platforms

Determines optimal order splitting and routing paths

Executes trades dynamically while monitoring performance in real time

The router evaluates not only headline price, but also:

Order book depth

Platform reliability

Fees and rebates

Slippage risk under volatile conditions

Large orders can be split across venues, sequenced over time, or rerouted mid-execution if conditions change. Failover mechanisms and redundant routing paths are built in to maintain execution reliability during market stress.

The result is better pricing, faster fills, and reduced slippage, delivered entirely at the application layer.

Perpetuals: True Multi-Venue Execution

CoinMarketCap ranks the top decentralized exchanges based on trading volumes, market share of DeFi markets.

Ranger Perps represents the first true perpetual DEX aggregator on Solana.

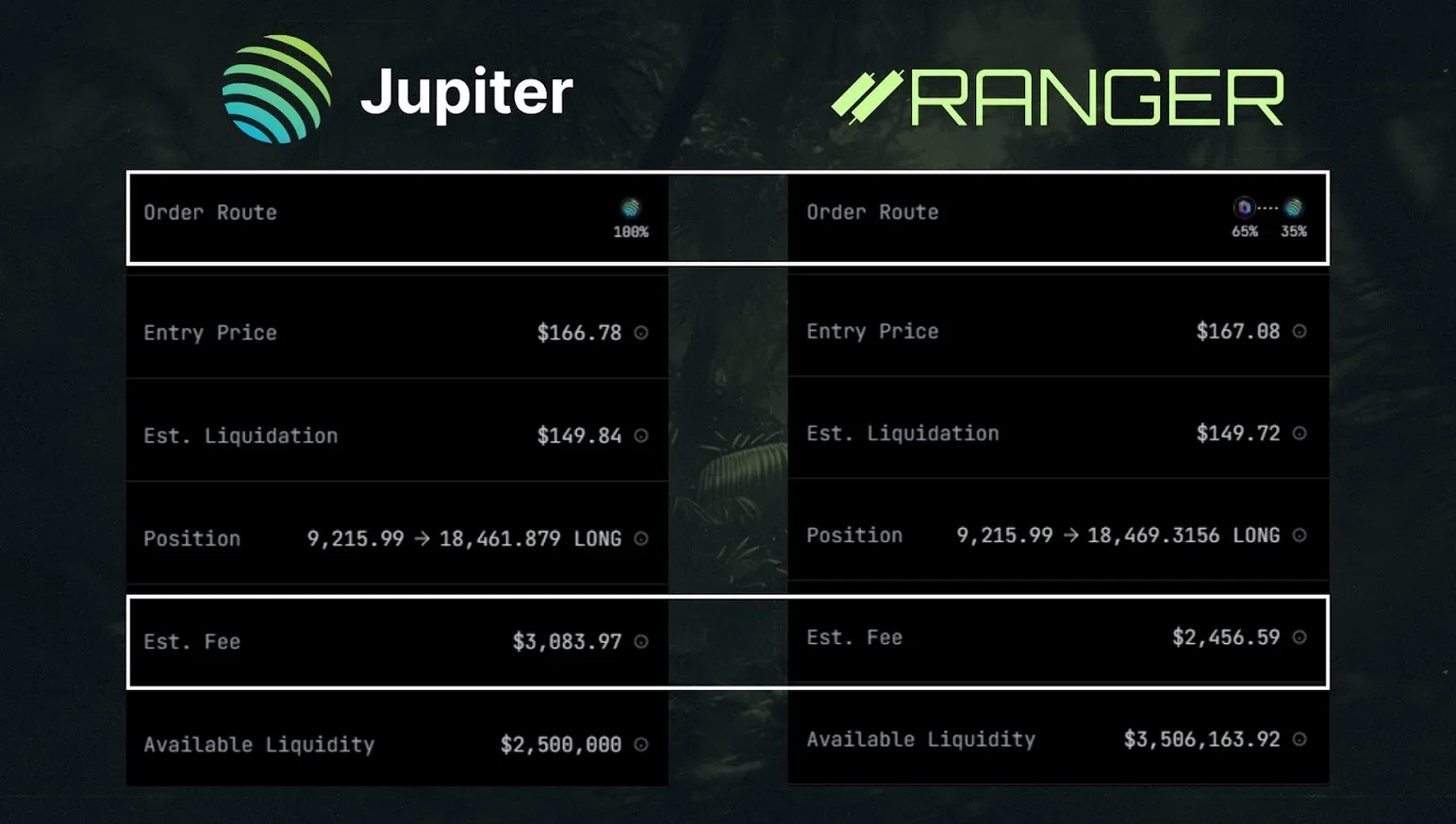

Instead of asking traders to choose between venues such as Drift, Jupiter Perps, Flash, or Hyperliquid, Ranger’s SOR automatically evaluates all supported platforms and routes orders to optimize for:

Best net execution price

Slippage minimization

Fee and rebate optimization

In practice, this can involve:

Routing an entire order to a single venue offering the best price

Splitting an order across multiple venues to improve blended execution

Selecting venues with slightly worse prices but materially lower fees when net costs are lower

Traders interact with a single interface, while execution intelligence operates behind the scenes.

Cross-Chain Execution Without Friction

Ranger extends aggregation beyond Solana through its Hyperliquid integration.

Using Privy for seamless wallet creation and Relay for secure execution, Ranger enables users to trade non-Solana perpetuals directly from the Ranger interface without bridging assets or managing multiple wallets. Settlement remains non-custodial, while execution complexity is abstracted away.

This approach treats cross-chain access as an execution problem, not a user experience burden.

Spot Trading: The Missing Half of DeFi Execution

Execution quality matters just as much in spot markets as it does in derivatives.

Ranger Spot is a MetaDEX aggregator purpose-built for Solana, sourcing liquidity not only from DEXs, but also from aggregators and RFQ-based venues. Integrated sources include:

Jupiter

DFlow

Kamino

OKX

Pyth Express Relay

Each venue offers different tradeoffs across price, fees, MEV exposure, and execution certainty. Ranger evaluates quotes from all sources simultaneously and routes trades to the optimal venue in a single transaction.

This broker-like execution layer allows spot traders to benefit from:

Best execution pricing

Lower effective fees

MEV-resilient routing where available

Minimal user overhead

Spot aggregation is a necessary complement to perp aggregation if DeFi is to support sophisticated trading workflows at scale.

Market Intelligence and Liquidation Mapping

Ranger also provides traders with liquidation data designed to surface areas of potential market stress.

By visualizing cumulative long and short liquidation levels alongside exchange-specific clusters, traders can identify zones where volatility may accelerate. This information supports more informed risk management and trade structuring, particularly in leveraged markets.

Perspective and Alignment

Ranger’s ongoing development is funded in part through an ownership-aligned ICO launched via MetaDAO. The intent is to expand team capacity and accelerate product development while maintaining alignment between users, token holders, and the long-term platform vision.

From our perspective, Ranger represents exposure to a broader structural theme: as DeFi grows more complex, aggregation and execution intelligence become foundational infrastructure rather than optional features.

Accessing the Platform

Readers interested in exploring Ranger’s execution model can access the application here:

This article is provided for informational purposes only and does not constitute investment advice, an offer to sell, or a solicitation of an offer to buy any security or token.